Potential of the Pharmaceutical Industry in Korea

home Korea Pharmaceutical Industry Information Korea Pharmaceutical Industry Potential of the Pharmaceutical Industry in Korea

Potential of Korea's pharmaceutical industry

Korean pharmaceutical market passed the $21 billion mark in 2018. Its growth has been driven by leading Korean companies, which have been releasing new global drugs and achieving technology exports.

Current Status of Korean Pharmaceutical Market

(Units: A hundred thousand dollars, %)

| Category | 2015 | 2016 | 2017 | 2018 | 2019 | Year-on-year growth rate | CAGR (‘15 ~ ’19) |

|---|---|---|---|---|---|---|---|

| Market size | 192,365 | 217,259 | 220,633 | 231,175 | 243,100 | 5.1% | 6.0% |

| Production | 169,696 | 188,061 | 203,580 | 211,054 | 223,132 | 5.7% | 7.0% |

| Exports | 33,348 | 36,209 | 46,025 | 51,431 | 60,581 | 17.7% | 16.1% |

| Imports | 56,016 | 65,404 | 63,077 | 71,552 | 80,549 | 12.5% | 9.5% |

| Trade balance | △ 22,668 | △ 29,195 | △ 17,052 | △ 20,121 | △ 19,968 | 0.7% | △3.1% |

Source: Press Release by the Ministry of Food and Drug Safety (August 3, 2020)

- The 2018 sales revenue of the listed drug companies (125) was $18,172 million in total (7.5% up from the previous year), with the Top 10’s revenue at $7,814 million (8.6%↑). * Sales revenue for '18 (based on consolidated financial statements) : (Yuhan Corporation) $1,362 million; (Korea Kolmar) $1,181 million; (GC Green Cross) $1,181 million; (Guangdong Pharmaceutical) $1,090 million; (Daewoong Pharmaceutical) $908 million; (Hanmi Pharm) $908 million

Four domestic companies are among the top 150 pharmaceutical companies in the world based on sales of prescription drugs.

* Sales of prescription drugs and global ranking for '18 (Evaluate 2019): Daewoong Pharmaceutical (111th, $ 844 million); Hanmi Pharmaceutical (119th, $ 773 million); Yuhan Corporation (122th, $ 762 million); Green Cross (139th, $ 563 million) - The Korean biologics market is valued around $2,026 million (2018), accounting for 10.2% of the entire pharmaceutical market, which is lower than the international level (28.2% in 2018).

- However, it has very high growth potential, with its production and export values rising greatly at a CAGR of 4.3% and 4.6% respectively for the last five years (2014-2018).

- In particular, the biopharmaceutical trade balance has remained surplus for four consecutive years following 2015 due to the increase in exports.

- Biosimilars are particularly expected to become a next-generation growth engine since 15 of the 20 drugs approved in Korea were developed by Korean companies.

Current Status of Korean Biopharmaceutical Market

(Units: a hundred thousand dollars, %)

| Category | 2015 | 2016 | 2017 | 2018 | 2019 | Year-on-year growth rate | CAGR ( ‘15 ~ ’19) |

|---|---|---|---|---|---|---|---|

| Market size | 16,406 | 18,308 | 22,328 | 22,308 | 26,011 | 16,6% | 12.2% |

| Production | 17,209 | 20,079 | 26,015 | 26,113 | 25,377 | -2,8% | 10.2% |

| Exports | 9,156 | 12,346 | 15,471 | 17,161 | 14,968 | -12,8% | 13.1% |

| Imports | 8,353 | 10,576 | 11,784 | 13,356 | 15,592 | 16,7% | 16.9% |

| Trade balance | 803 | 1,770 | 3,687 | 3,804 | -624 | -116,4% | - |

Source: Press release by the Ministry of Food and Drug Safety

Current Status of Korean Pharmaceutical Companies

(Current status of businesses) Out of 798 pharmaceutical companies in Korea, 571 (72%) reported production records for 2018, indicating an average production of 45 items per company.

(unit: number, %)

| Category | 2015 | 2016 | 2017 | 2018 | 2019 | CAGR ( ‘15 ~ ’19) | |

|---|---|---|---|---|---|---|---|

| Number of manufacturers | 586 | 635 | 623 | 616 | 639 | 2.2 | |

| Manufacturers with production records | 597 | 599 | 588 | 571 | 612 | 0.6 | |

| Number of items | Total | 25,890 | 26,397 | 26,293 | 26,239 | 28,363 | 2.3 |

| Drug products | 17,907 | 18,546 | 19,291 | 19,539 | 20,703 | 3.7 | |

| Drug substances | 7,983 | 7,851 | 7,002 | 6,700 | 7,660 | △ 1.0 | |

| Number of sellers | 24,693 | 25,862 | 24,951 | 26,223 | 26,817 | 2.1 | |

Source: Press Release by the Ministry of Food and Drug Safety

R&D Investment of Major Korean Pharmaceutical Companies

(Current status of R&D) Pharmaceutical majors in Korea are striving to enhance competitiveness to the level of advanced countries by launching new drugs developed in Korea in overseas markets through the continuous expansion of R&D investments.

- The total R&D investment by the pharmaceutical companies listed in Korea (125 companies) was $1,423 million in 2018, which accounts for 7.7% of the total sales.

- The R&D investment by the top 10 companies was $787 million, which was more than half of the total amount of R&D investment by all the listed pharmaceutical companies, accounting for 10.0% of the total sales.

- The total R&D expenditure of domestic listed innovative pharmaceutical companies (37 companies) accounted for 74% of the cumulative R&D expenditure reported by total listed companies and the proportion of R&D expenses was 9.3%.

(Unit: a hundred thousand dollars, %)

| Category | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| R&D investment | Listed companies | 10,927 | 13,707 | 13,432 | 15,666 | 21,916 |

| Top 10 companies | 6,056 | 7,985 | 7,371 | 8,667 | 9,106 | |

| Innovative pharmaceutical companies | 8,457 | 10,693 | 10,368 | 11,665 | 13,443 | |

| Ratio to sales | Listed companies | 6,9% | 8.1% | 7.1% | 7.7% | 9.1% |

| Top 10 companies/td> | 9,1% | 11.6% | 9.3% | 10.0% | 8.0% | |

| Innovative pharmaceutical companies | 8.4% | 9.8% | 8.7% | 9.3% | 9.5% | |

Source: Press Release by the Ministry of Food and Drug Safety

- Owing to the increase in the elderly population and the rising incidence of chronic diseases necessitating increased use of medicines, innovations of the biopharmaceutical industry, such as cell therapies and gene therapies, continue to expand.

- It is expected that the number of licenses will increase after the establishment of the Conditional Approval System, with 15 domestic cell therapies approved by Sewon Cellontech's 'Condron' ('01') until '18. * This is a new permit system for cell therapy products for the treatment of life-threatening diseases or severe irreversible diseases (Press Release by the Ministry of Food and Drug Safety, July 2016).

- Currently, a total of seven stem cell therapies have been released worldwide, of which four are developed domestically. * (Pharmicell) Hearticellgram-AMI, (Medipost) Cartistem, (Antrogen) Cupistem, (Corestem) Neuronata-R

R&D Investment of Major Korean Pharmaceutical Companies

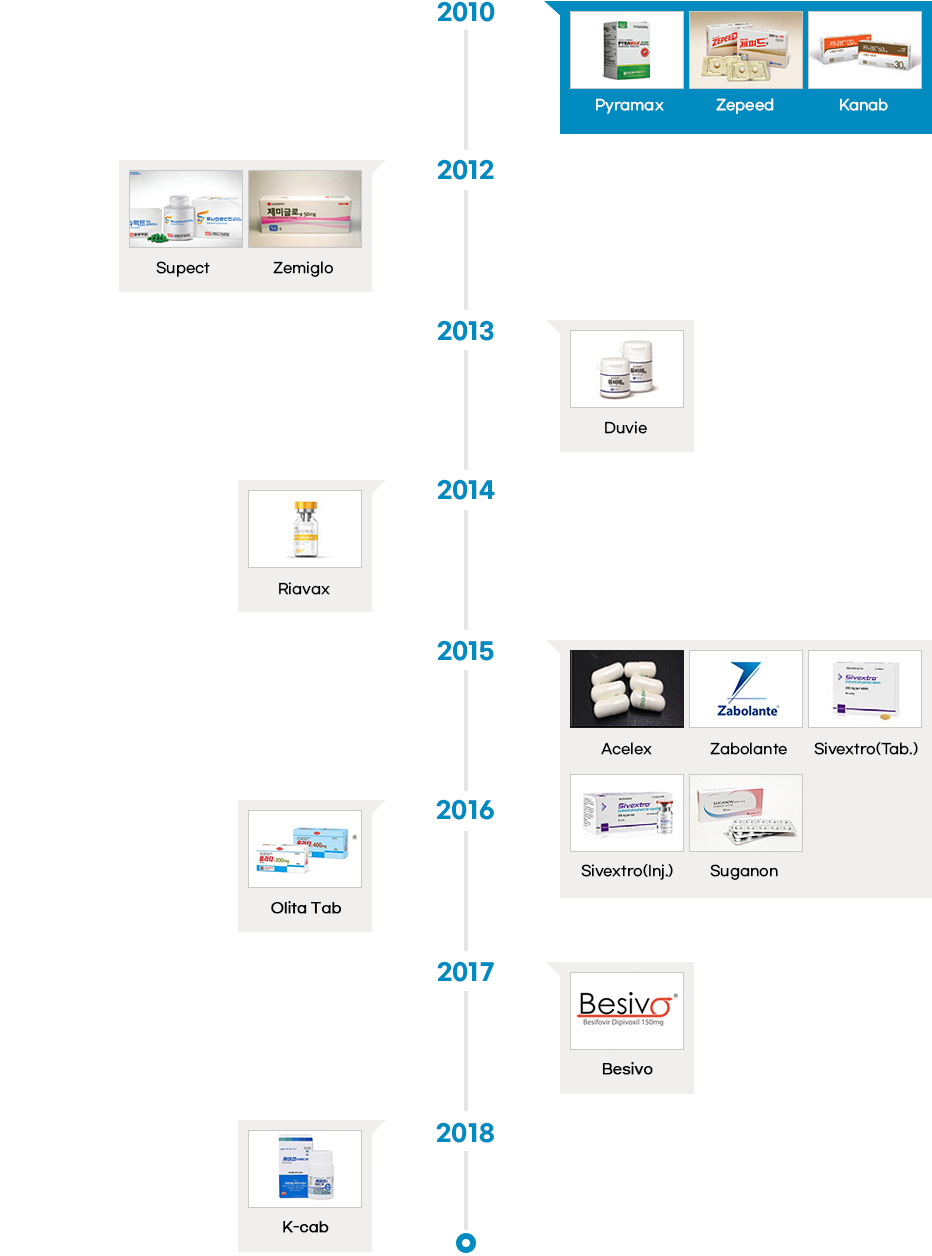

(Current status of new drug development) A total of 29 new drugs were developed as of December 2019 through the efforts of Korean pharmaceutical companies. * 1999-2014: 21 new Korean drugs were developed → 2015-2018: 8 new Korean drugs were developed.

| Company | Product | Efficacy/Effectiveness | Approval Date |

|---|---|---|---|

| Crystal Genomics Inc. | Acelex Capsule | Treatment for osteoarthritis | Feb 5, 2015 |

| DongWha Pharm. Co., Ltd. | Zabolante tablet | Antimicrobial agent (antibiotics) | Mar 20, 2015 |

| Dong-A ST Co., Ltd. | Sivextro tablet | Antimicrobial agent (antibiotics) | Apr 17, 2015 |

| Sivextro injection | |||

| Dong-A ST Co., Ltd. | Suganon tablet | Antidiabetic drug | Oct 1, 2015 |

| Hanmi Pharmaceutical Co., Ltd. | Olita tablet | Cancer drug (lung cancer) | May 13, 2016 |

| Ildong Pharmaceutical Co., Ltd. | Besivo tablet | Hepatitis B treatment | May 15, 2017 |

| CJ Healthcare | K-Cab Tab | Gastroesophageal reflux disease (GORD) | Jul 5, 2018 |

| Yuhan Corporation | Leclaza | Non-small-cell lung carcinoma (NSCLC) | January 18, 2021 |

| Celltrion, Inc. | Regkirona | Covid-19 antibody therapy | February 5, 2021 |

| Hanmi Pharm. Co., Ltd. | Rolontis | A novel long-acting neutropenia drug, | March 18, 2021 |

Current Status of Domestically-developed Drugs in Terms of Approval at Home and Abroad

(Overseas market entry) Korean companies are creating high value-added products through the expansion of their global market shares by launching domestically-developed new drugs in the global market and facilitating the process of out-licensing to overseas markets.

- Fifteen Korean drugs have obtained approval in the US and EU since 2014, ramping up sales to developed markets.

SK Biopharm proceeded independently to the third phase of clinical trials and released new drugs developed in Korea to the United States. These include XCOPRI (‘19), which was approved by the FDA.

| Company | Trade Name (Manufacturer) | Reference Drug | Efficacy / Effectiveness | Approved in Korea | Approved Overseas | |

|---|---|---|---|---|---|---|

| EMA | FDA | |||||

| Dong-A ST Co., Ltd. | Sivextro* | New drug | Oxazolidinone antibiotic | Apr '15 | Mar '15 | Jun '14 |

| Daewoong PharmaceuticalCo. Ltd. | Meropenem** | Merrem (AstraZeneca) | Carbapenem antibiotic | Apr '10 | - | Dec '15 |

| Nabota** | Botulinum toxin(Allergan) | Glabellar wrinkles | Nov '13 | - | Jan '19 | |

| Celltrion Inc. | Remsima* | Remicade(Johnson & Johnson) | Rheumatoid arthritis (RA), | Jul '12 | Aug '13 | Apr '16 |

| ulcerative colitis, etc. | ||||||

| Truxima* | Rituxan (Roche) | RA, chronic lymphocyticleukemia, non-Hodgkin’slymphoma, etc. | Nov '16 | Feb '17 | ||

| Herzuma* | Herceptin(Roche) | Breast cancer | Jan '14 | Feb '18 | Dec '18 | |

| Linezolid** | Zyvox(Pfizer) | Tuberculosis, wide range of antibiotics | - | - | Apr '19 | |

| TEMIXYS | Zeffix (GSK),Viread (Gilead) | AIDS | - | - | Nov '18 | |

| Samsung BioepisCo., Ltd. | Benepali (EU)* Eticobo (US)* Etoloce (Korea)* |

Enbrel(Amgen) | RA, psoriasis, etc. | Sep '15 | Jan '16 | Apr '19 |

| Flixabi (EU)* Renflexis (US)* Remaroche (Korea)* |

Remicade (Johnson & Johnson) |

RA, ulcerative colitis, etc. | May '16 | May '16 | Apr '17 | |

| Imraldi (EU)* Hadlima (US)* Adalloce (Korea)* |

Humira(AbbVie) | RA, Crohn's disease,inflammatory boweldiseases, etc. | Sep '17 | Aug '17 | Jul '19 | |

| Ontruzant(EU)* Samfenet (Korea)* |

Herceptin(Roche) | Breast cancer | Nov '17 | Nov '17 | Jan '19 | |

| SK Chemicals | AFSTYLA | New biologic | Antihemophilic drug | Jan '20 | Jan '17 | May '16 |

| SK Biopharm | Sunosi | New drug | Sleep disorder | - | Jan '20 | Mar '19 |

| aceuticals | XCOPRI® | New drug | Epilepsy | - | - | Nov '19 |

Source: Korea Health Industry Development Institute (KHIDI)

(The * mark attached to the trade name indicates biosimilars, and ** mark with the trade name indicates generic medicine.)

Technology Transfer Performance of Domestic Biopharmaceutical Companies in 2020

| Time of contract | Company | Product or technology | Exporter | Partner | Contract price |

|---|---|---|---|---|---|

| Jan. | Daewoong Pharmaceutical | Pek suprazan (Gastroesophageal reflux disease treatment) |

Mexico | Moksha8 | $50 million (Deposit not disclosed) |

| Apr. | Lego Chem Bio Science | ADC source technology ConjuALL | England | Iksuda therapeutics | $470 million |

| May | Lego Chem Bio Science | LCB73 (ADC anticancer drug candidate) |

England | Iksuda therapeutics | $227 million (Deposit: $5 million) |

|

Jun. |

PharmAbcine | Non-tumor treatment (New drug candidate substance) |

U.S. | Woncal Biopharm | Not disclosed |

| Mecoxcuremed | M002-A (COVID-19 treatment candidate substance) |

EU | Tube Pharma | Not disclosed | |

| Alteogen | ALT-B4 (Human hyaluronidase) |

private | Top 10 global pharmaceutical companies | $3.65 billion (Deposit: $16 million) |

|

|

Aug. |

Hanmi Pharmaceutical | Epino Peg Dew Tide (NASH treatment) |

U.S. | MSD | $870 million (Deposit: $10 million) |

| Daewonng Pharmaceutical | Peksuprazan (Gastroesophageal reflux disease treatment) |

Brazil | EMS | $72.58 million | |

| Yuhan Corporation | YH12852 (Functional gastrointestinal disease treatment) |

U.S. | Procesa Pharmaceutical | $415 million (Deposit: $2 million) |

|

| Sept. | SCM Life Ssicnece | High-purity mesenchymal stem cells | Russia | Famimex JSC | Not disclosed |

|

Oct. |

Olix | OLX301D (Subretinal fibrosis, wet macular degeneration) |

France | TEA Open Innovation | 16,695 million€ (Deposit 5.3 million€) |

| SK Biopharm | Senobamate (Treatment for epilepsy) |

Japan | Ono Pharmaceutical Industry | 53.1 billion yen (Deposit 5 billion yen) |

|

| Voronoi | VRN07 (Lung cancer drug candidate substance) |

U.S. | Oric Pharmaceuticals | $621 million (Deposit: $13 million) |

|

| ABL Bio | LCB71/ABL202 (ADC anti-cancer drug candidate substance) |

China | Seastone Pharmaceuticals | $363.5 million (Deposit: $10 million) |

|

| Nov. | Isu Abxis | ISU305 (Paroxysmal nocturnal hemoglobinuria treatment) |

Russia | Pharmasysntex | Not disclosed |

|

Dec. |

Genexin | GX-P1 (Immunosuppressant) |

U.S. | Turret Capital | $1.5 billion |

| Legochem Bioscience | LCB67 (ADC anti-cancer candidate substance) |

U.S. | Pixies | $2,994 milliion | |

| Total | Approx. KRW 11,595 billion | ||||

Source: Company disclosure data

Based on its technological competitiveness and quality drugs, the pharmaceutical industry in Korea has considerably strengthened its ability to develop innovative drugs in a short period of time, managing the entire process from R&D and clinical trials to the manufacturing of drugs domestically. The impressive growth made in the last few years suggests that Korea-based pharmaceutical companies are ready to take the leap forward as global players.

[Pipeline] Development of Innovative Medicines and Strong Pipelines across Various Therapeutic Areas

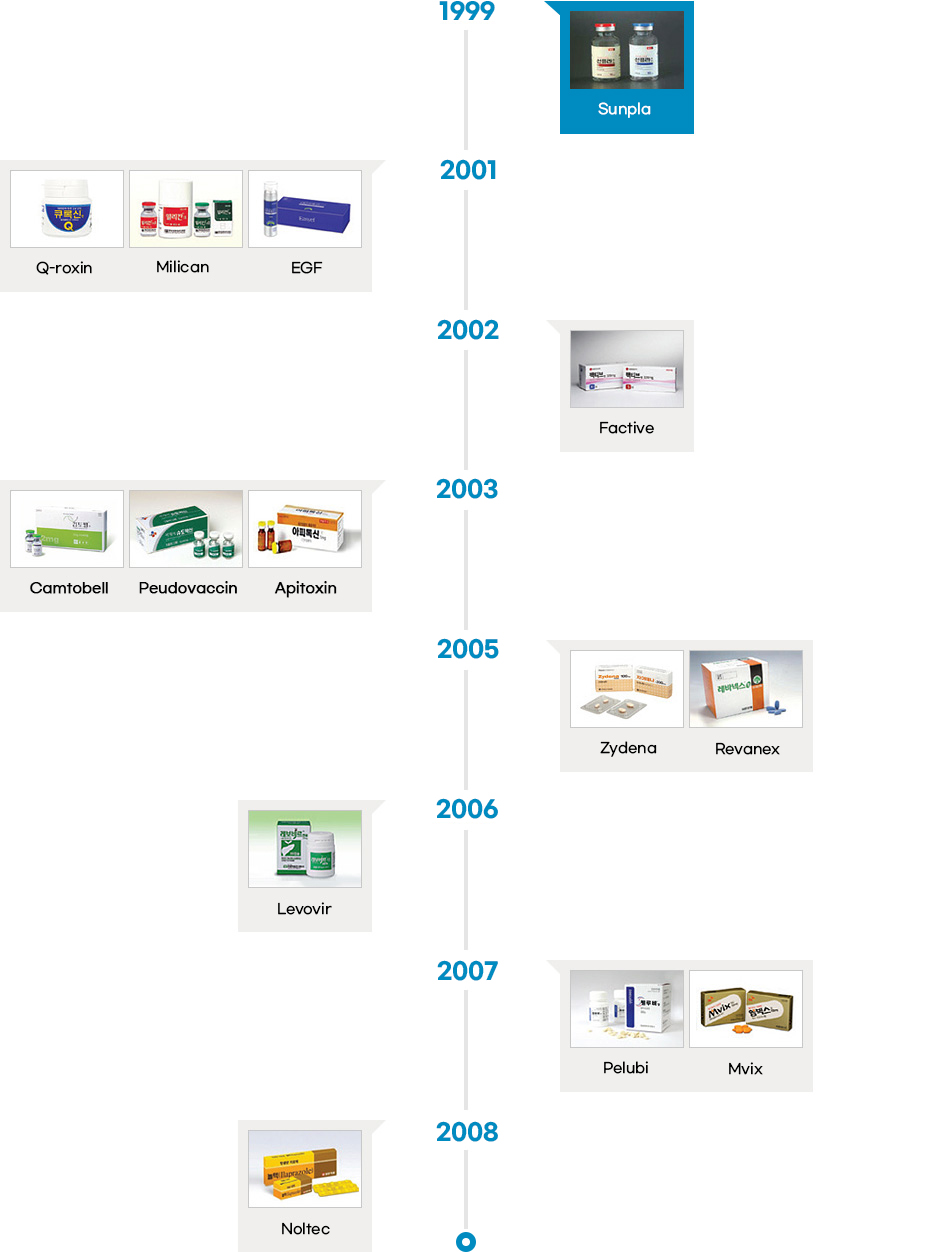

- The local pharmaceutical industry started manufacturing both finished products and drug substances in the 1960s, and developed new processes in the 1980s. Following the early phase of drug development in the late 1980s, Korean pharmaceutical industry started to develop innovative drugs in the 2000s. Since then, the Korean pharmaceutical industry has been successfully developing some of the most innovative and incrementally modified drugs.

- Since the introduction of the chemical compound patent system in 1987, the number of innovative drugs introduced in the country has also increased at a rapid pace. Korea has seen development of innovative drugs across various therapeutic areas, from “Sunpla Injection,” a treatment for stomach cancer developed by SK Pharmaceuticals in 1999 to “K-CAP” a treatment for gastroesophageal acid reflux developed by CJ Healthcare in 2018. So far, Korean pharmaceutical companies have developed therapies in an array of areas including oncology, antibacterial, gastritis, respiratory infections, duodenal ulcer, diabetic foot ulcer, erectile dysfunction, hepatitis B, and hypertension.

Launch of Innovative Drugs (A total of 26)

(Clinical Trials) Clinical trials grew dramatically from both qualitative and quantitative perspectives

- Already on a clear growth track with its high level of clinical trial capabilities and reliable data, Korea is emerging as a core clinical trial destination in the Asian pharmaceutical market. Twenty-two Korea-based major healthcare organizations, including Seoul National University Hospital, Samsung Seoul Medical Center and Asan Medical Center, have won global certifications for their clinical study environment helping the country to build clinical infrastructure at a global level. Thanks to this advanced infrastructure, Korea ranked 7th in the world in terms of global clinical trial protocol market share in 2018, moving one level down from 6th Place in the previous year. The number of domestic clinical trials increased to 679 in 2018, up nearly 3.2% compared to 658 in 2017. Its share in global clinical trials decreased from 3.51% in 2017 to 3.39% in 2018.

- The number of Multinational Regional Clinical Trials (MRCTs) conducted by multinational pharmaceutical companies in Korea has also increased sharply since the country introduced the International Conference on Harmonization of Good Clinical Practice (ICH GCP) in 2000. Especially, Pfizer formed a partnership with Korea to collaborate on its global clinical program in 2008, selecting four of its nine global Core Research Sites (CRSs) in Korea.

- The ongoing “Smart Clinical Trial Platform’ program that involves seven major hospitals is expected to contribute to achieving higher clinical trial efficiency within Korea under the assumption that the platform technologies to be developed through this program are widely adopted by Korean hospitals. Active use of the EMR data in conducting feasibilities and matching patients with the complex inclusion/exclusion criteria would greatly improve efficiency together with Korean health authorities adopting a more streamlined and transparent process for authorization of clinical trials (Reference: Chee DH. Korean Clinical Trials: Its Current Status, Future Prospects, and Enabling Environment. Translation, Clin. Pharmacol. 2019;27(4):115-118).

[Manufacturing] High Level of Competitiveness and Ability to Generate Extensive Pipelines for Innovative Drugs

- Pharmaceutical companies in Korea have been working to ensure that their drug manufacturing facilities meet rigorous global standards. To reflect global trends, the guidelines on Good Manufacturing Practices (GMP) were changed from dosage forms to prior approval of individual items in 2008. As the guidelines were shifted from management of dosage forms to that of individual items based on a step-by-step process through 2010, the quality assurance system for domestically manufactured drugs reached a global level.

- In addition, Korea has acquired the capability to conduct drug R&D for compounds and commercial technologies, including organic synthesis, agents and global clinical trials. This was achieved through the development of generics and incrementally modified drugs. Korea is also a leader in the pharmaceutical biotechnology area. With fruitful R&D results including development of the world’s first stem cell therapy and xenotransplantation of pancreatic ducts, Korea is in an advantageous position to become a leader in promising future industries. The level of therapeutic technologies in cardiac surgery and management, and cervical cancer in Korea is the best among other OECD countries, according to OECD Health Data 2009.

- Korea's pharmaceutical industry is shifting its focus from the domestic market to the global market, and the world is now paying attention to Korean pharmaceutical industry based on successful partnerships.