발간보고서

home > 자료실> 발간보고서

- 글자크기

COLOMBIA: A PHARMA MARKET OVERVIEW

| 작성자 | 관리자 | 카테고리 | 전문가 인사이트 |

|---|---|---|---|

| 작성일 | 2018-11-26 | 조회수 | 5,280 |

| 원문 | 한국보건산업진흥원 | ||

| 출처 | |||

COLOMBIA:

A PHARMA MARKET OVERVIEW

Edson Luis de Brito, Pharm.D. – Executive Consultant in Korea Heath Industry Development Institute, KHIDI

October, 2018

INTRODUCTION

Colombia is a country located at the northern of South America. Its landscape is marked by rainforests, Andes Mountains and numerous coffee plantations. In the high-altitude capital, Bogotá, the Zona Rosa district is known for its restaurants and shops. Cartagena, on the Caribbean coast, has a walled colonial Old Town, a 16th-century castle and nearby coral reefs.

The Colombian Population is around 49,000,000 inhabitants, a mix of descendants of American natives, Europeans and Afro-descendants, which made this population strongly heterogenic and mixed races, even though Colombians are less ethnically mixed compared to Brazilians, for example.

Living in a democratic presidential regimen in the last decades and occupying the 29th position in the global economy, with a GDP of USD 310BN (2017), Colombia was successful in the attempting to change its image of a country dominated by drug dealers and cartels of cocaine producers, improving many of their social problems and diversifying the local economy. Colombia GDP per capita is around USD 8.000 annual basis and the country has shown an economic growth around 4.6% in average per year.

The pharmaceutical market in Colombia is characterized by showing a supply chain that it goes from the production to the distribution of medicines and their consumption in hospitals or in individuals.

This paper aims to provide general information about the situation of this market, identifying its composition, characteristics and the ways in which the actorS intervene in the control of the price of medicines.

Pharmaceutical Market in Colombia – Brief

The Colombian pharmaceutical market became more interesting in the recent years (2000-2015) due to a deep deregulation in several fields of the economy in the country, including the opening for prices of medicines, aiming to have more competitiveness between the drugmakers, provide conditions for customer in the retail and create policies for assistance of the population in their health conditions.

That deregulation, also gave to private companies supported by the Colombian State, the responsibility to provide health services to the population, in a business model called EPS – Entidades Promotoras de la Salud (Health Providers Entities), and IPS – Instituiciones Promotoras de la Salud (Helath Providers Institutions), while EPS is related to provide treatment and health care electively, IPS are the hospitals and clinics that extend the coverage to high complexity and surgery & nurse care, where people who are inserted in the productive economy pay for the service, and the population in need are supported by the government. The basic idea was to provide same good quality of health services to the population as a whole.

However, this model, somehow, created a distortion in the prices of the pharmaceuticals products to the end user with time, leading to the Government to interfere with this, creating new policies of payment (reimbursements) for that EPS and IPS among other particular situations.

As we can realize, the market of pharmaceuticals in Colombia is characterized by a strong institutional consumption, being the Colombian Institutions (EPS and others) responsible for 60% of the units of medication and for 40% of the values.

The Colombian Market is estimated in USD 4.6 Billion Dollars in values and 35 Million Units [figure 1], occupying the 5th position of the biggest pharmaceutical market in Latin America as a whole, therefore it is considered as a market information, once it is, likewise other Latin America’s Markets, very dependent of the growth of the economy.

[Figure 1 – Colombian Pharmaceutical Market]

Health System in Colombia

In 1993, it was established a scenario in which the provision of health services will be in charge of different public entities as private allowing users free choice. In this sense health promoting entities (EPS), the institutions that provide services of services (IPS), the National Council for Social Security in Health (CNSSS) and the national health superintendence (SNS).

The EPS, are the basic organizational core of the social security system in health, likewise are the entities responsible for the affiliation and register of the affiliates of the contributory regime and the collection of their quotations, by delegation of the Solidarity and Guarantee Fund.

Its function will be to organize and guarantee, directly or indirectly, the provision of the mandatory health plan to affiliates and to rotate, within the terms provided by law, the difference between the income from contributions of their affiliated companies and the value of the corresponding payment units for solidarity and guarantee fund.

The IPS are hospitals, clinics, offices, laboratories, centers basic care and other health services centers and all professionals who grouped or individually offer their services through of the EPS.

The Colombian Ministry of Health has the main objective to formulate policies, strategies, programs, and projects that guide the resources and actions of the general security system social health; as well as the relevant scientific and administrative standards with a view to the promotion of health, the prevention of disease, diagnosis, treatment and rehabilitation. Their main functions are

• Schedule the distribution of resources that correspond to the territorial entities.

• Dictate the scientific norms that regulate the quality of services and the control of risk factors.

• Monitor the compliance of the apolitical. Plans, programs, projects and other rules.

• Advise entities and institutions of the health sector.

• Set and collect fees for the issuance of permits, licenses, registrations and certifications.

• Direct and control research on needs and resources in health matter.

• Issue administrative rules, in relation to issues and regimes tariffs for the provision of health services.

• Regulate the collection, transfer and dissemination of information.

• Prepare studies and proposals at the request of the CNSSS (National Council for Social Security in Health)

CNSSS is led by the Ministry of Health and is the general director of systems, organizations of agreement between the different members; their decisions will be mandatory and may be revised periodically. The CNSSS main functions are

• Define the Obligatory Health Plan (POS) and the manual of essential drugs

• Define the contribution amount

• Define the value of the Capitation Payment Unit and its variations according to age, sex and geographical location.

• Define co-payment regimes and moderating quotas. Define recognition regime, disability payment

• And maternity leave.

• Define the measures to avoid the adverse selection of users.

Institutional Market

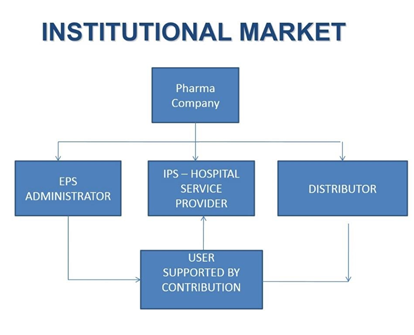

The attention to Institutional Market (non-retail) is the main interest of the pharmaceutical and health products. This market is responsible for 60% of the whole Colombian pharmaceutical market in units and 40% in values. Otherwise it is divided by three different channels:

- Private Channel (EPS&IPS)

- Semi Private Channel (EPS,IPS & GVT)

- Public Channel (GVT)

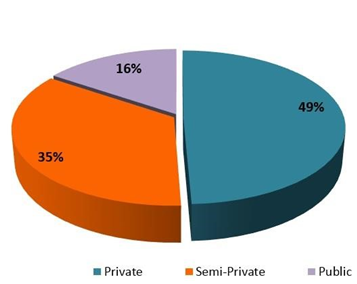

The private channel is the most prevalent and move around USD 1.35BN dollars/year. This channel is responsible for 49% of the moving of resources that are paid to EPS & IPS. In this channel the bargain was less present, making the prices more out of control and creating non fair profitability for many companies and distortions in the market. With the interference of Colombian Government in this field, via Ministry of Health, the pharmaceuticals prices decreased, sometimes in more than 50% of the previous prices, creating a more balanced environment for the market. [Figure 2]

Semi Private Channel has a prevalence of an amount around 968Million dollars/year equivalent to 35% of the resources of whole Institutional Market. Government Purchasing, EPS and IPS companies are together in this channel, usually giving support for diagnosis, tests and some shareable treatment. [Figure 2]

Public channel is responsible for the amount close to USD 442 Million dollars or 16% of the institutional market. In this channel is inserted special patients in non-usual situations, that has no resources to establish and run their own treatments and also not covered by EPS`s and or IPS`s. [Figure 2]

[Figure 2] – Institutional Market and its channels.

In Colombia there are about 90 pharmaceutical companies, between nationals and multinationals. 57 of them are part of the Chamber of Pharmaceutical Industry of ANDI and several belong at the same time to one of two other guilds: the Association of Pharmaceutical Laboratories of Research and Development (Afidro), which brings together 23 large multinationals, and the Association of Pharmaceutical Industries (Asinfar), to which 26 Colombian pharmaceutical companies are affiliated.

Also the logistic operators play an important role in the activities of the institutional market [Figure 3].

When analyzing the industry figures, another point can be taken into account, between prescribed and overthe-counter medications In Colombia, advertising of the prescription drugs are prohibited, this is why it can be seen acetaminophen or ibuprofen television advertising but not drugs for cancer or hepatitis.

[Figure 3]. Organization of Institutional Market in Colombia

Retail Market

The Private Retail or Commercial Market (Non-Institutional) in Colombia is more related to the nonprescription drugs and in some specific situations, for prescription medications. Few prescription drugs are sold in this market, once those drugs are preferably sold at Institutional Market as we see previously.

The points of sales are, basically, the drugstore and supermarket chains, which supply directly to the customers.

In terms of numbers, the commercial market in Colombia is responsible by to move around USD 1.94BN in values and 21 Million Units annually.

Conclusion

Colombian pharmaceutical market presents, in a certain point of view, some complexity. This characteristic raises in an environment highly dominated by oligopolies of buyers, distribution channels well defined and organized, drugstore chains that can cover the customer satisfactorily.

Otherwise, in Colombia, there is a strong competition related to the sales of pharmaceuticals. From one side, there are the original drugs or brand manufactured by big multinational pharma companies that invest a lot of money in research and development to create a product that will be protected by a patent that gives them the benefit of his marketing and is a barrier against unauthorized copy.

At the other extreme there are the generic pharmaceutical products produced by domestic drugmakers, that they manufacture to fulfill the same functions of brand-name medication, but they are elaborated at a lower cost since they do not need to invest in innovation and product development.

Despite of this low cost in the production, during some long period in the previous years, Colombian pharma companies had grown and reached almost extortive profitability, but in a recent government intervention, prices have been cut from 30 to 50 percent, and in some cases they have bordered the 80 percent.

In general, this market is not too much attractive for companies that expect to export final dosage formulations, except for products not available inside the market. In other hand, Active Pharmaceutical Ingredients with good quality are welcome. Also, new drugs protected by patent and biosimilar are in the radar of Colombian potential distributors.

The challenge, in some cases, lies in the regulations of INVIMA, the regulatory agency of the country, which can create some controversial situations to grant a registration of these new potential products.

References

1. ESTUDIO ECONÓ MICO DEL SECTOR RETAIL EN COLOMBIA, LAURA LUCÍA AMÉZQUITA G.; YEINNI ANDREA PATIÑ O M.

2. LA INDUSTRIA FARMACÉUTICA Y SU PARTICULARIDAD EN LA DELIMITACIÓ N DEL MERCADO RELEVANTE, María Bernarda

Carpio Frixone*.

3. CARACTERIZACIÓN DE LA INDUSTRIA FARMACÉUTICA EN COLOMBIA Y ANÁLISIS DE LA COMPETENCIA DESDE LA

PERSPECTIVA DE LA PLANEACIÓN ESTRATÉGICA, R.G. Ardila

4. Innovación empresarial: análisis de cinco empresas farmacéuticas de Barranquilla – Colombia, Ana GUTIERREZ Castañeda; Yanis MIRANDA Acosta; Luis ORTIZ Ospino; Jairo CASTAÑEDA Villacob ; Jhon Key DIMAS Reyes

5. “ ESTUDIO DEL SECTOR FARMACEUTICO COLOMBIANO CORRESPONDIENTE AL PROCESO DE ADQUISICIÓ N, DISTRIBUCION, SUMINISTRO Y CONTROL DE MEDICAMENTOS A TRAVES DE UN OPERADOR LOGISTICO PARA LOS USUARIOS DEL SUBSISTEMA

DE SALUD DE LAS FUERZAS MILITARES DE LAS VIGENCIAS 2014 A 2018” BAJO LA MODALIDAD DE MONTO AGOTABLE

6. INFORME SOBRE EL SECTOR FARMACÉUTICO, Consejo General de Colegios Oficiales de Medicos de Espana

7. Dinâmicas e Perspectivas do Mercado Farmacêutico e Consumer Health; Sydney Clark

8. http://www.dinero.com/edicion-impresa/negocios/articulo/sector-farmaceutico-aumenta-inversiones-en-colombia/252649

9. http://www.portafolio.co/opinion/redaccion-portafolio/mercado-farmaceutico-descripcion-cifras-94562

10. http://es.investinbogota.org/sectores-de-inversion/farmaceuticos-en-bogota

11. http://www.scielo.org.ve/scielo.php?script=sci_arttext&pid=S1315-95182010000200002

12. http://www.corficolombiana.com/WebCorficolombiana/Repositorio/Informes/archivo2262.pdf

13. http://repository.icesi.edu.co/biblioteca_digital/bitstream/10906/77621/1/teoria_fusiones_horizontales.pdf

14. http://www.inviertaencolombia.com.co/Adjuntos/077_Sector%20Farmac%C3%A9utico.pdf

15. http://www.minsalud.gov.co/Documentos%20y%20Publicaciones/Politica%20Farmac%C3%A9utica%20Nacional.pdf

- 이전글 이전글이 없습니다.

- 다음글 다음글이 없습니다.