발간보고서

home > 자료실> 발간보고서

- 글자크기

PRODUCTIVE DEVELOPMENT PARTNERSHIP PROGRAMS - BRAZILIAN CURRENT STATUS

| 작성자 | 관리자 | 카테고리 | 전문가 인사이트 |

|---|---|---|---|

| 작성일 | 2019-04-01 | 조회수 | 4,736 |

| 원문 | |||

| 출처 | |||

PRODUCTIVE DEVELOPMENT PARTNERSHIP PROGRAMS - BRAZILIAN CURRENT STATUS

Edson Luis de Brito, Pharm.D. – Executive Consultant at Korea Heath Industry Development Institute, KHIDI

글 Edson Luis De Brito

(에디손 브리토)

KHIDI 해외제약전문가

상임컨설턴트

세부전문분야

컨설팅 내용

- 중남미지역 진출 전략 및 시장 개철

- 중남미 시장 분석, 마케팅, 사업개발

- 임상시험 모니터링, 코즈메틱 분야

INTRODUCTION

One of the biggest challenges faced by the public healthcare system in Brazil is the coverage of the treatment costs of the population.

Due to Brazil having a system which warrants the access to health for everyone by law, added to the imbalance in the economy and, time to time, huge discrepancies in the currency rate (Dollar-USD x Real-BRL), managing the Health budget is one of several situations performed by the SUS – Sistema Único de Saúde (in English – Unified Health System) – and the Brazilian Ministry of Health.

The constant need to include new therapies and health technologies to the SUS, has affected the public health services, especially because Brazilian healthcare industry, including the pharmaceutical industry, is tremendously dependent of international sources of manufactured products and raw materials to produce drugs for the market.

In front this situation, in 2008, Brazil started to develop programs aiming to decrease the dependence and the expenditures related to acquisition of healthcare technologies and medications, the Productive Development Partnership (PDP) Programs.

These programs, once that they are sensitive to Ministry of Health budgets, suffer influences of the governments on the go, and depending on the government, the possibilities some changes can happen.

The target of this article is to give a brief idea about the PDP programs; how PDP projects are managed; the possible outcomes; the possible changes to take place and the opportunities of entering of foreigner companies, mainly Korean pharmaceutical companies.

BRAZILIAN PHARMACEUTICAL MARKET - RETAIL AND INSTITUTIONAL

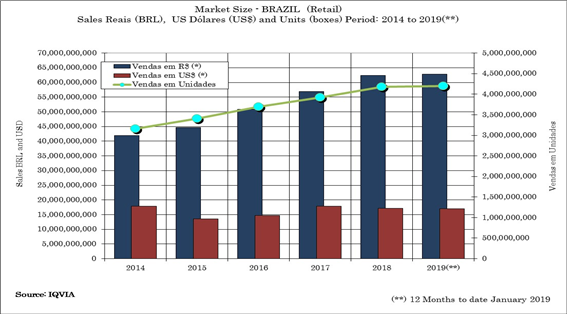

The Brazilian Retail Pharmaceutical market has demonstrated capability to grow more than the average of the others segments in the economy in the last five years. This growth has been more visible in the OTC and Generic segments, even though the prescription drugs segments is keeping its growth as well. As a whole, the CAGR is around 5.74% from 2014 to 2019 (12 months – January ~January to date) [figure 1].

[Figure 1]. Brazilian Pharmaceutical Market Size. Source: IQVIA

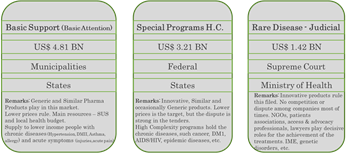

Similarly, the Institutional market also has presented an evolution in terms of units and in the amount of public resources to support the basic healthcare assistance; the special programs and mainly the support to rare diseases.

While the basic healthcare assistance receive almost half of the BRL 37MIO [almost USD 9.2 BN] for pharmaceuticals to support more than 75% of the patients covered by SUS, the other half of these resources (around USD 4.6 BN) is dedicated to support patients needing high complexity treatments and high cost pharmaceutical and biological products [figure 2].

[Figure 2]. Division of SUS resources and the responsible for coordinating in each section, including remarks.

With the increasing, in the last years, of the insertion of more and higher cost treatments and chronic and/or rare disease, the need to create mechanisms to decrease the costs to the SUS became a tough mission to the federal administration. For this reason, the Brazilian Ministry of Health decided to create the Productive Development Partnership Programs, giving the opportunity to the private and public manufacturers joint themselves to research and develop these therapies to supply SUS with strategic pharmaceutical products, according SUS considerations.

PDP PROGRAMS

As mentioned previously, the Productive Development Partnership Programs are established by the Ministry of Health as the way to decrease the SUS dependence of more expensive healthcare products from international sources, producing them in the country to supply the public health service, in other words the main reason of PDP Programs I to increase access to pharmaceutical products and health products considered strategic for the SUS, through the strengthening of the Brazilian industrial complex.

There are 8 targets to be accomplished in the PDP programs;

1 - Expansion of access strategic products;

2 - Dependence reduction of technologies and products;

3 - Maintenance of the Purchase Power;

4 – Protection of Brazilian Interests in healthcare;

5 – Technological development stimulation;

6 – Domestic development and Manufacture of strategic products;

7 – Technological & Financial sustainability;

8 – Public production stimulation.

The partnership basically consists in a drug development, holding the 22 public pharmaceutical companies owned by the Brazilian State and a private companies operating locally or with a foreigner producer connected with the local company through license or marketing authorization. One company which possesses certain strategic product or technology agree to transfer it to the public company. As counterparty, the Ministry of Health agree to purchase the product subject of the development during a period from 3 to 10 years, without dispute in a tender with other possible competitor with original or similar product.

To candidate to a PDP project, a rational should to be follow strictly.

The first step is to certify that the PDP candidate is listed in SUS strategic products directory, after this a meeting request should to be made to Brazilian Health Industrial Complex Executive Group (GECIS) which will schedule and issue the interest for discussion. After this, four steps more is required in phases.

The phase 1 is a phase of preparation of the project and harmonise the interest with all involved parties, public and private companies.

In this phase 1, it will be done the following activities:

-

The design of the PDP project, made by partner companies

-

Submit the Project to the Ministry of Health

-

Accompaniment of the project forwarded to the PDP Special Secretary of Ministry of Health;

-

After the stamp of the Ministry of Health, a spoken presentation should be made presentation performed by a representative of the Public Company.

-

Ministry of Health team will evaluate the project Evaluation of the project

-

Some Comments and Adjustments in project can be made

-

Ministry of Health approval or disapprovals

The time expended in this phase is frequently unpredictable, but depends on the team dedicated in the preparation of project presentation.

In the phase 2, the steps to follow are:

-

The implementation of the PDP project itself

-

The Signature of the contract joining the Private and Public Companies

-

The product co-development or the delivery of the product dossier from the private company to the public company

-

The Registration Petition to ANVISA

-

The sharing the legacy for the development of technological and industrial capabilities

-

The ANVISA Product registration Issuance (Register approval)

The phase 2 has two important milestones to emphasize: The Contract signature, which will determine the terms and how long the product will have to be concluded and the time to supply to the Ministry of Health, and the ANVISA registration issuance, that will be the starting point of the time.

In the phase 3, is the phase when it will requested to have important activities such as:

-

Transference and absorption of the technology, development, or industrial & technological capability performed by the private company or the private partnership

-

First supply of the product fruit of PDP project registered by the public or private entity, which can be done by import process

-

Sanitary issuance of the register to the public Institution

-

Second supply of the product, which can be done by import process

-

Post register alterations (manufacture site, insertions)

-

Tech transfer and absorption of the product from PDP program as scheduled.

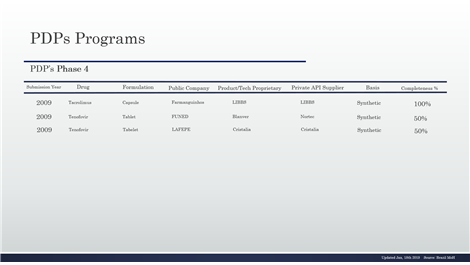

The phase 4 is the final phase, and from this point, the product should to be produced by the public company, and according the law, no more imported.

It is important to mention that if some non-accomplishment of the phases become known, the project can be withdrawn.

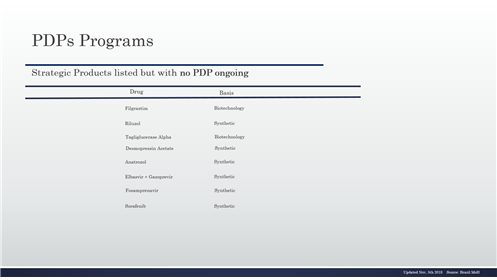

In March 2019 there were 136 products in the list of the SUS, from these around 104 were in progress with the PDP program, and 32 without any program to start up.

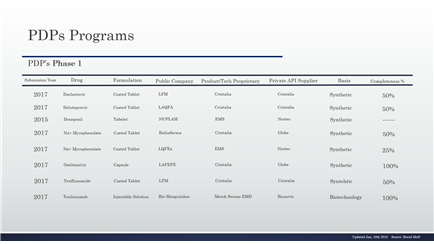

The full list and their respective status are in the tables (table 1 to table 17).

Table 1 – PDP in the phase 1 and details

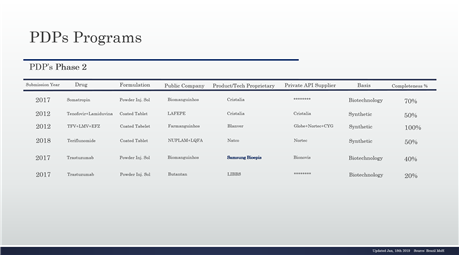

Table 2 – PDP in the phase 2 and details

Table 3 – PDP in the phase 2 and details, continuing

Table 4 – PDP in the phase 2 and details, continuing

The products listed by the SUS are in the most, products related to treatment of chronic diseases, diseases with severe outcomes and rare diseases. They are the products that have impacted the cost and expenditures in almost 50% of the full budget for pharmaceuticals at public health system. They are the only (the list) products considered by the PDP programs.

Also, the public companies are prepared to receive the tech transfer, however not all of them, because part of them have a gap in terms of equipment and qualified personnel.

Table 5 – PDP in the phase 2 and details, continuing

Table 6 – PDP in the phase 2 and details, continuing

In other hand, there are many public companies that are in the state-of-the-art in R&D. This is the case of Instituto Vital Brasil - IVB, Instituto Butantan, BioManguinhos. Farmanguinhos, TECPAR, FUNED, Hemobrás, and the public companies linked to the Brazilian Armed Forces (LQFEx, LQFMA, LQFFA).

Even though those companies having the same equipment, the researchers use to be more experienced and have high leverage of education and knowledge.

Table 7 – PDP in the phase 2 and details

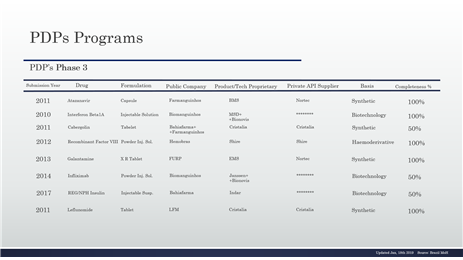

Table 8 - PDP in the phase 3 and details

As mentioned Brazilian Government is the supporter of the PDP programs, incentivizing them in the way to give conditions to become the assistance more comprehensive for most of SUS patients.

With a new government in charge from 2019, it is expected that some changes happen in a middle or short time, in terms of PDP.

The new government took over the administration purposing a new model of administration, with a huge fight against corruption and crime, the stiff control of public expenditures and deep review in the healthcare programs. Due to problems relate to legal safety, the current Minister of Health,

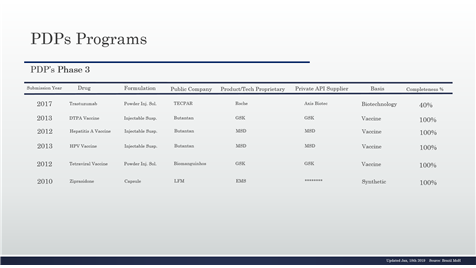

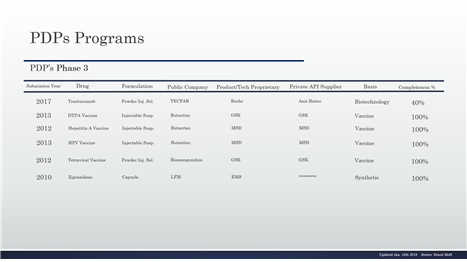

Table 9 - PDP in the phase 3 and details continuing

Table 10 - PDP in the phase 3 and details continuing

Dr. Luiz Henrique Mandetta, decided to pause and put on stand by the PDP programs, until a complete landscape can be shown.

After this, it is expected that the program will return, probably with new products and other possible changes that can give a better performance and outcomes to the new PDP projects.

Table 11- PDP in the phase 3 and details

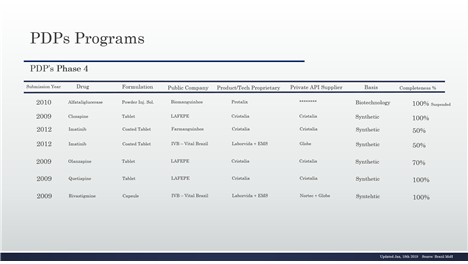

Table 12- PDP in the phase 4 and details

In other hand, the last purchase made by the Ministry of Health through PDP happened in October 2016, revealing that something is not progressing well in the program.

Anyhow, it will expected some modifications such as:

- Rethought of the role of public companies, once there is a potential privatization of public companies, and there is a possibility that some of them carrying or not the development as legacy

- More clarification in the terms of contracts made by the MoH and the companies;

Table 13- PDP in the phase 4

Table 14- PDP in the withdrawn

- Resolution of conflicts results of legal insecurities.

With this, PDP programs can advance much more, giving opportunities for foreigner companies, including Korean companies, in the expansion of business and spreading more appearance in Brazilian Institutional Markets.

Table 15- PDP in the withdrawn continuing

Table 16- PDP in the withdrawn

RECOMMENDATIONS FOR FUTURE PDP PROJECTS

Even though, the temporary pause in the PDP programs already ongoing and the future with new drugs and new biological products, is expected that companies with technology to develop those ones can have benefits joining with public and private companies locally to run a project.

In this row, some recommendations for those companies, if followed, can help them to have more success in the full PDP program.

Table 17- Strategic Products Listed not having PDP project.

These recommendations are:

1) To figure out a big and well reputed private local pharma company as the partner, preferably those that have innovative products insertion profile, because when a famous and bigger Brazilian pharma company is chosen, that one can have preference to the best public companies, for partnership, and when a potential foreigner partner candidate can learn more about the public company in charged to be the co-developer of the project and align the relationship between private and public partner that can increase the chance of success.

2) Put all efforts to design a flawless PDP Project, once a well-done project is crucial. However, it will be presented to GECIS – Grupo Executivo do Complexo Industrial da Saude - by the public company representative. Paying a strict attention to the terms of project conclusion, because the Minister of Health Committee will evaluate this. Negative evaluation will lead to the disapproval of the project.

3) In despite all the efforts in the project, it will be required an interesting amount of patience, because things usually go slowly and gradually in Brazil, and work hard it will be requested for both sides. The main target of the private company is to sell to public sector, but it is necessary to understand that the purchase process will take place at Phase III, after ANVISA registration approval. It takes time, and under the terms of the PDP contract, even with one, there`s no guarantee or obligation of acquisition through PDP, by the Government.

CONCLUSION

It is predicted that retail Brazilian Pharmaceutical Market will remain growing and tends to reach the Compound Average Growth Rate – CAGR - of 5% or more, basically skyrocketed or flat by the OTC and Rx market.

The Institutional market, in other hand, is more comprehensive and will remain growing, and the pressure for cost reduction is imperative.

The crescent expenditures in the public market healthcare, in special for high complexity treatments and rare disease will keep growing, being a challenge for the government, states and municipalities administrations.

Due to the Government, through MoH and SUS, being a powerful payer, SUS will remain using its purchase power to obtain better conditions pressuring for, as previously mentioned, cost reductions.

The PDP programs, in this scenario, are the main weapons used by the government to be decrease the dependence of the products with higher prices charged at the more innovative therapies for rare disease treatments. In this meanwhile, the local pharmaceutical industry search to gain capabilities to supply by themselves or develop sources that bring more advantageous financial conditions to the public health system. It is expected, however, that PDP programs tends to be modified to the main purpose to get legal security fulfilment of the terms, and focus in the more sophisticated products, and capable public companies.

REFERENCES

http://portalms.saude.gov.br/saude-de-a-z/parcerias-para-o-desenvolvimento-produtivo-pdp

https://www.jota.info/paywall?redirect_to=//www.jota.info/tributos-e-empresas/saude/mandetta-promete-rever-contratos-de-pdp-e-deve-retirar-indicacao-a-anvisa-03012019

https://www.who.int/medical_devices/global_forum/J01.pdf

https://www.bio.fiocruz.br/index.php/noticias/1032-medicamentos-biologicos-lideram-lista-de-novas-propostas-de-pdp

http://portalms.saude.gov.br/ciencia-e-tecnologia-e-complexo-industrial/complexo-industrial/produtos-estrategicos

https://rmconsult.blogspot.com/2018/11/lista-de-produtos-estrategicos-para-o.html

https://regulatoriolifescience.com/2018/03/27/atuacao-das-industrias-farmaceuticas-nas-parcerias-pdp-com-setor-publico-em-2017/

https://www.conass.org.br/wp-content/uploads/2018/11/RENAME-2018.pdf

http://terciotti.com.br/news/ministerio-define-lista-de-produtos-estrategicos-para-o-sus/

http://bvsms.saude.gov.br/bvs/saudelegis/gm/2018/prt0731_27_03_2018.html

- 이전글 이전글이 없습니다.

- 다음글 다음글이 없습니다.